Bitcoin price is very volatile. However, despite all that bitcoin is believed to be the new modern cryptocurrency, that will overtake fiat currencies in the near future. Or if that does not happen for some reason the chances the bitcoin becoming a preferred method of payment is very likely. However, before we go into the facts and the details about the bitcoin phenomena. I would like to begin with a bit of background.

Predominantly for the 19th and 20th centuries, the world’s most successful currencies were with a fixed value for gold, silver, and other precious metals. The creation of such a valuable connection between gold and money helped to attract investors gain confidence in the nation.

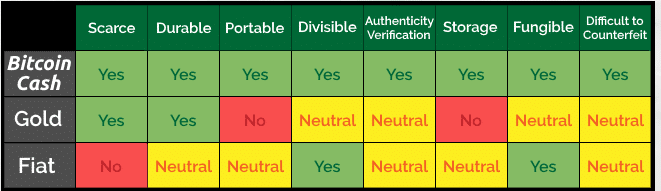

Nowadays, people need a new modern fast, and reliable way of payment where the costs are close to nothing. Bitcoin has started to shape the face of the internet and the way how we pay for our products and services. It cannot be counterfeited, however, it is possible to be spent on more than one place, but this would require a tremendous amount of computer power.

In another word, it is close to impossible to be counterfeited. Bitcoin seems to be the solution for all of the problems that appear to come on mind for every fiat paper-based currency controlled by the governments. However, its biggest disadvantage is volatility. We have observed some crazy and unpredictable behavior of cryptocurrency. Even only one negative tweet can drag the price down and bring chaos for many investors.

The Real Problem with the Paper Fiat Currencies

The problem with the paper fiat currencies is that soon or later the value of any paper currency has been inflated down to complete worthlessness. It is obvious that when people are involved in taking such decisions facing the supply and growth of the currency. Many unwanted rows of events will follow. However, I will leave this for you to decide and I will not speculate on the matter with paper currencies.

The best part about Bitcoin is that no government has direct influence over bitcoin growth and monetization, instead, the cryptocurrency is maintained by a decentralized network. If I have to explain this in English, this means that not only one person maintains the so-called ledger, instead, it is maintained by all participants at the same time. The hard decisions are taken by developers, not by politics.

What on Earth are Bitcoin and Bitcoin Cash?

Bitcoin is a cryptocurrency. As from 1st of August 2017, the introduction of Bitcoin Cash came along, doubling the number of Bitcoins an individual owns. Bitcoin Cash is the newborn continuation of the Bitcoin project as peer-to-peer digital cash. This new term Bitcoin Cash is the fork of the Bitcoin chain ledger. The rules and the way it works has been re-written by the community behind. This project similarly to Bitcoin is decentralized, with no central bank or trusted third parties to limit its potential. Some of the promises given by the Bitcoin cash community are as follows:

- Fast as the Light: Fast transactions approved within seconds

- Reliable: A network that runs without any flows

- Low Fees: You can now send money globally for pennies

- Simple: Easy to use with no hassle

- Stable: Preferable payment system that has proven store of value

- Secure: Improved and more robust blockchain technology

The very simple reasons for the cryptocurrency to split into BCH and BTC on August 1st, 2017 are very simple. Some of the developers within the community disagreed with the original version peer-to-peer proposed by Satoshi Nakamoto. The original argument stated by the experts of Bitcoin Cash was the size of the block, which was limited to 1 MB size capacity. The original block size was deliberately designed to hold 1MB size. Predominantly for security reasons and leading advantage between competitors. There are currently ongoing talks between the developers to create another fork for bitcoin with a block size of 2MB. However, as already mentioned above this hides potential risks and drawbacks which leads many to disagree with the new fork. The argument is that if the block size is increased this means faster transactions and lower fees.

The only current drawback, which I believe will not take a long to change is Bitcoin’s expansive global exchange network. Bitcoin is currently available for trading across continents regardless of the pointed disadvantages that the cryptocurrency is currently facing. Bitcoin Cash is the new generation improved blockchain. Since its release, only a few major investors stepped up in the game of Bitcoin Cash. The full list is here.

What is the Real Reason for the Split?

This was causing initially huge problems not only for the users but for the developers too. The waiting time for a single transaction doubled, the fees involved in a single Bitcoin transaction also skyrocketed. Bitcoin was only able to process only 3 transactions per second. All of the issues above caused the cryptocurrency to devalue itself and investors quickly lost interest. However, despite the lost value from investors and the primitive plans for scaling-up and growth the cryptocurrency continues to surges.

Why Bitcoin Continues to Grow in Value?

Despite Bitcoin splitting into a second fork, the currency continues to see huge market value growth. The reasons for that are:

Increased investment

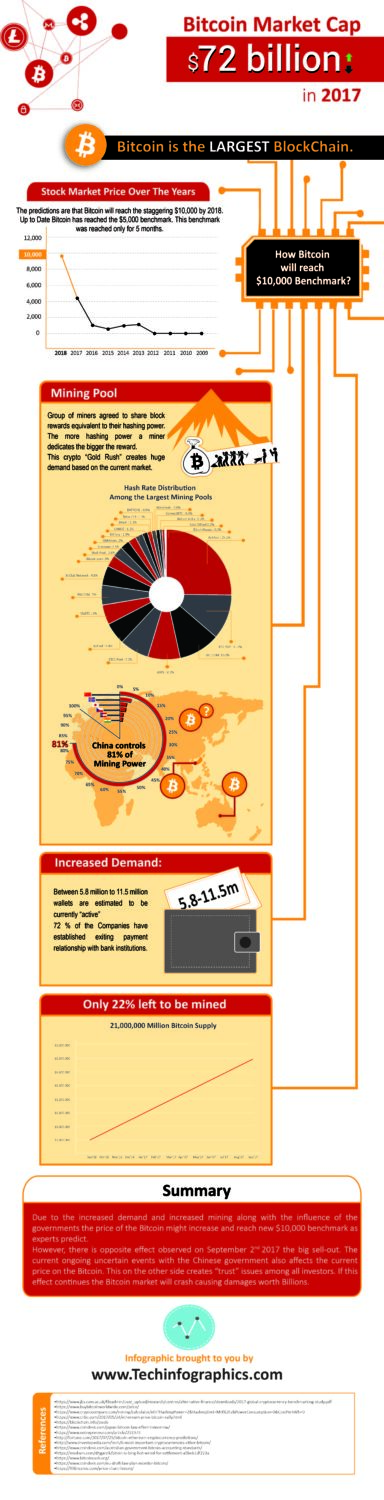

- The market is currently flooded with all types of cryptocurrencies and they are all come with different market value. Some of the cryptocurrencies have become more favorable than the others causing people to invest in different cryptocurrencies. Many people see the idea of the volatile Bitcoin cryptocurrency as an asset and investment. As you might know, the demand for the product on the market increases its value. However, this can quickly change and the value of the cryptocurrency will drop due to the demand. We all have witnessed the recent ICO ban in China and how almost 20% of the value was lost only within 24h. It took a while for bitcoin to recover back to $4,000. Then another unconfirmed news coming from China made the price drop below $4,000. The reason why China’s behavior is affecting bitcoin prices so intensively is that 81% of the mining pools are based in China due to the cheap power. The infographic shows the distribution of mining pools in each country.

Japan and China

- As of 1st April, Japan passed a law to legalize Bitcoin as a method of payment. It was a debate lasting months, which was going against money laundering and organized crime.

This bold move Japan undertook caused the cryptocurrency to sore rapidly. On the other side, this means, that Japan will have to change some of its current laws and banking system.

Chinese authorities have had long-lasting dislikes against Bitcoin. However, recent updates indicate that China once again has grown its tolerance against Bitcoin. The reason for the interest was caused by the big drop in the differences in the Bitcoin prices between the US and Chinese Exchanges. This suggests that for investors heading towards Bitcoins is less risky. However, despite all the sympathy, China is a wild card.

Australia

The Australian government is interested to undertake similar steps to Japan legalizing Bitcoin and being a legal method of payment in Australia. However, if this is about to happen, we are about to see another surge of Bitcoin. I know many people will contradict me with statements that the price of Bitcoin will never increase and reach $10,00 by 2018. Tim Draper is a long-term bitcoin investor and he bought nearly 30,000 bitcoins from an auction led by the FBI, after shutting down a website on the black market.

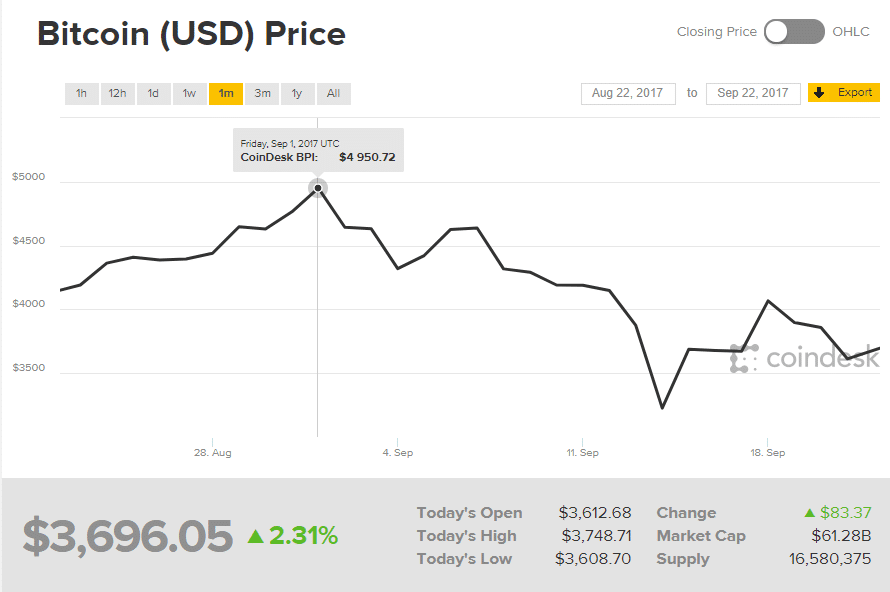

Tim Draper predicts that the price of 1 bitcoin will reach $10,000 by 2018. His prediction was given in 2014. The current price for Bitcoin is $ 3,969.38 at the time of writing this article. As described above the bitcoin is extremely volatile. While gathering all the data for this article. I have observed various changes in the bitcoin price.

The price hit the $5,000 benchmark before the news that China has set a ban for ICO. I did not expect this row of events to change the price so aggressively.

What is about to happen with Bitcoin Price?

Above you can see some of the strong evidence why this might happen in near future. Some strong predictions were made by experts that the Bitcoin value will go up to $10,000 by 2018. However, this is clearly the only speculation. Nobody can tell exactly what will happen with the Bitcoin. I can tell you only one thing based on my research that Bitcoin is unstoppable and no government has the power to stop it.

My own personal opinion is that Bitcoin might hit new benchmark. However, this is my own personal opinion. Enjoy this infographic brought to you by Technifographics feel free to share but do not forget to give is a credit. I would be happy to answer any questions that might arise over the Bitcoin topic.

Know more from experts from bitcoinevolution.co.